Hedge Fund Case:

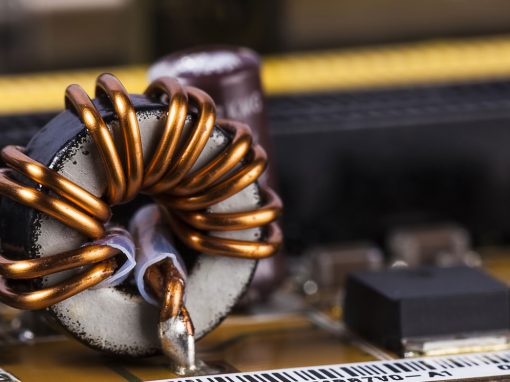

Investment Due Diligence On Semiconductor/R&D Leader

Context:

A leading hedge fund was seeking to invest $1B into the public equity of a Fortune 500 semiconductor and R&D leader.

Engagement Overview and Impact:

Red Chalk Group was engaged to validate and augment an investment thesis hinging on continued “above market” profitability owing to superior innovation, R&D, and licensing activities. Key questions included level of innovation, the impact of an evolving telecommunications ecosystem, and defensibility of a historically successful business model.

- We conducted market and target due diligence to prove out the thesis that the target was innovating at a pace greater than most industry peers, who were unable to compete on core semiconductor and mobile-related R&D.

- Moreover, we conducted over 35 industry interviews with leaders across the value chain including former CXOs, corporate VC executives, engineering executives, and IP/licensing leaders that collectively had intimate knowledge of industry dynamics, trends, and the likely scenarios going forward.

- We confirmed limited existential threat to the core “profit engine” of the target, instead, pointing to a long-term scenario in which increased innovation and R&D reliance would be likely while identifying key risks and opportunities including IoT and 5G.

Private Equity Case:

Commercial Due Diligence On Lighting Industry and Target

Context:

A top 50 LBO fund was evaluating a potential corporate carve out opportunity of an underperforming incumbent player within a transforming industry.

Engagement Overview and Impact:

Red Chalk Group was engaged to conduct commercial due diligence on the general lighting industry and a Fortune 500 target to ultimately develop an investment thesis related to a corporate carve-out of a business unit.

- We conducted industry diligence, characterized the broader landscape, key moves by competitors and peers, including notable “exits,” and assessed the secular trends / ”fundamentals” to inform the team on the target’s long-term (5 years out) position.

- Moreover, we conducted due diligence on the target to understand strategic, operating, and financial dimensions, ultimately identifying significant performance improvement opportunities given the “disruption” taking place across lighting.

- Ultimately, while we offered three strategic options / pathways for value creation, we highlighted outsize risk from a precipitous market shift and commoditization from Asian entrants, resulting in a “no-go.”

Private Equity Case:

Commercial Due Diligence On Diversified Industrial Manufacturer

Context:

A top 50 LBO fund was evaluating a potential corporate carve out opportunity of a non-strategic, non-core business unit from a decentralized industrial conglomerate.

Engagement Overview and Impact:

We worked with the deal team to develop an investment thesis, high-level value creation opportunities, and prospective transaction discussion material related to a corporate carve-out ($2B+) from a Fortune 500 diversified industrials player.

- Our team deeply characterized the “potpourri” of assets within the business unit and highlighted management’s inability to drive synergies across the platform.

- Additionally, we highlighted the attractive investment opportunity and prepared a set of value creation opportunities including an asset/labor rationalization plan, platform consolidation opportunities, and potential non-core asset spinouts.

- Finally, we assisted the team through preparation of management discussion material

Private Equity Case:

Commercial Due Diligence on Security and Surveillance Industry and Target

Context:

A top 50 LBO fund was evaluating a potential corporate carve out opportunity of an underperforming acquisition that failed to generate synergies within a diversified industrial player.

Engagement Overview and Impact:

Red Chalk Group was engaged to conduct commercial due diligence on the security and video industry and target to develop an investment thesis, identification of the drivers of underperformance under its current corporate parent, competitive threats, and a refreshed strategy.

- We identified the key drivers of underperformance including a laggard product strategy, suboptimal salesforce structure, and a weak channel strategy

- Also, we developed a set of performance improvement initiatives including supply chain variabilization, product portfolio rationalization, and sales force optimization

Venture Capital Case:

Portfolio Company Strategy For Alternative Energy Player

Context:

A VC-backed portfolio company seeking to leverage its proprietary biotechnology to address the burgeoning CO2 CCS market was asked by VCs to develop a comprehensive go-to-market strategy.

Engagement Overview and Impact:

Red Chalk Group was engaged to develop a commercialization strategy to guide the early-stage portfolio company’s business development and go-to-market efforts as it related to target industrial markets.

- We developed a comprehensive industry diagnostic to characterize and prioritize the market fundamentals of each hypothesis, inclusive of size, growth, industry concentration, and economics, on industrial-scale market opportunities: upstream oil and gas (enhanced oil recovery), midstream gas (e.g., natural gas processing), commercial/industrial gas production (e.g., hydrogen), and power generation (e.g., coal fire plants).

- Moreover, we validated the “comparative economics” of adopting the novel technology across key markets, demonstrating that the financial model (lower upfront CapEx and reduced ongoing OpEx) may be particularly attractive for a subset of opportunities in the near-term, facilitating a thesis that net project surplus would be significant despite switching costs.

- Ultimately, we advised the executive team on a commercialization strategy with a prioritized set of end markets, a low-cost channel strategy focused on EPCs and turnkey industrial technology providers, and recommended a business model focused on licensing and consumables.

Alternative Investment Case:

Financial model to value technology and IP assets in a JV entity

Context:

A $25B multi-strategy alternative investment management firm sought to make an investment in a joint-venture backed by leading intellectual property (patent) assets in the TMT domain.

Engagement Overview:

Red Chalk Group was engaged to develop a scenario and financial valuation model to help guide the investment thesis and articulate the potential economics to satisfy the funds IRR model.

- Developed a deep understanding of the underlying patent portfolio asset composition and how they mapped across key technology domains, including the smartphone, telecommunications hardware, and PCs.

- Developed two rigorous financial models: comparable trading market value and discounted cash flow model based on projected licensing revenue adjusted for risk, posture, and operating expenses.

- Ultimately, we advised the investment team on the merits of pursuing the JV based on the economic upside and the satisfaction of specific investment criteria.