ABSTRACT: Industry 4.0 represents the next Industrial Revolution, one where manufacturers will have to contend with the Information Age fully. Digitization is a common theme across all industries but only now are industrial verticals awakening to the opportunities (and risks) it poses to their businesses. The Industry 4.0 journey is not a 5- or 10-year project; the full scope of Industry 4.0 may only be realized decades from now. Every manufacturer will have to undergo the Industry 4.0 journey: developing connected products, creating data analytics solutions, and integrating with other Big Data platforms, which culminate in outcome-based models. Along this journey are several key decision points that will guide what role a manufacturer can play within Industry 4.0; however, the journey for every player will begin with data collection and connectivity – without these fundamental capabilities, manufacturers will find themselves an analog player in a digital world.

What is Industry 4.0?

The world has gone through three major industrial revolutions, starting with the invention of steam power in the 1800s, to Ford’s assembly line breakthrough in the 1900s, to the robotic, automated factories of today. Industry 4.0 (also referred to as the Industrial Internet of Things / IIoT) has emerged as the next revolution, where data transforms into an essential resource within a factory and embedded connectivity enables seamless communication between the factory floor, supply chain partners, and demand centers.

At the core of Industry 4.0 lies data – there is an oft-repeated adage that “data is the oil of the 21st Century”, and this is especially true in the case of Industry 4.0, where data will be the fuel that can create value for an entire value chain. While many “connected” products have already launched in consumer-facing applications (e.g., connected home / car), manufacturing / production verticals have yet to fully embrace the value of connectivity.

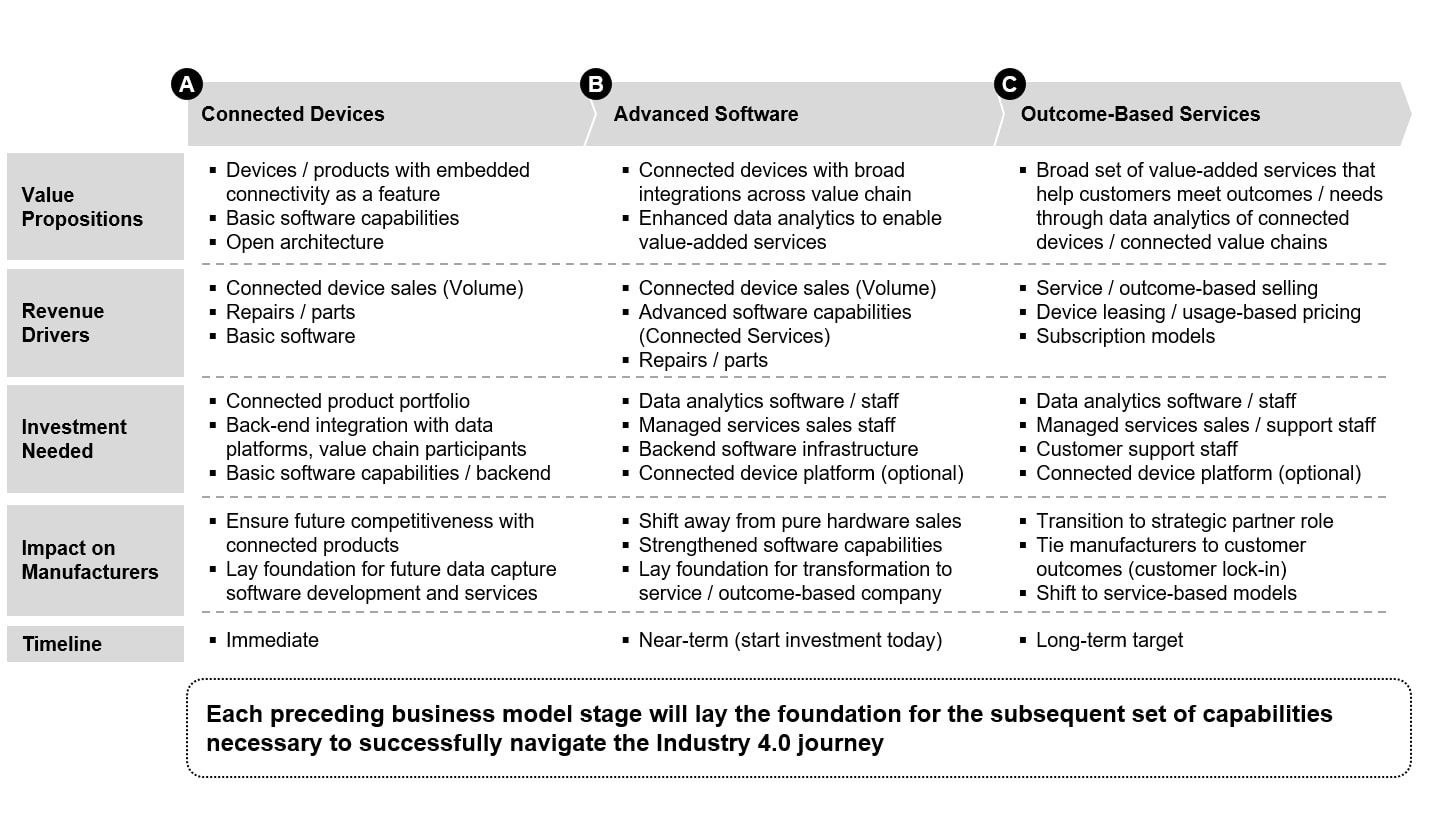

In Red Chalk Group’s view, Industry 4.0 represents the evolution of manufacturing, augmenting core production capabilities with advanced software and then developing a set of value-added, outcome-based services based on these augmented capabilities. This journey from product to service can serve as a framework for manufacturers looking to explore the opportunities Industry 4.0 can unlock (See Figure 1).

Figure 1 – The Industry 4.0 Journey

Setting the Stage for 4.0 Adoption

Similar to the revolutions that preceded Industry 4.0, a set of enabling technologies are required to reach maturity before widespread adoption is possible. We believe the building blocks of Industry 4.0 are now mature – the costs of connectivity (e.g., WiFi / BLE) are declining, the size and affordability of sensors and data storage systems are improving, and the value extracted from collected data is increasing through improvements to data analytics algorithms, AI / machine learning, and cloud computing.

Returning to the oil analogy, data collection represents drilling for oil, data storage / cloud computing refines and prepares the data for use, while data analytics and AI / machine learning represent the engines that drive a majority of end-user value. However, these aspects are inextricably linked with each other – without data collection, there’s nothing for an analytics platform to study, and without data analytics, there’s little insight that can be extracted from just raw data.

With the building blocks of Industry 4.0 reaching maturity, manufacturers will face growing pressure to incorporate elements of Industry 4.0, particularly connectivity, into their products. A spectrum of players has already formed, with leaders like GE investing heavily in digital and data analytics initiatives, while the vast majority of manufacturers are only in the formative steps of exploring connectivity.

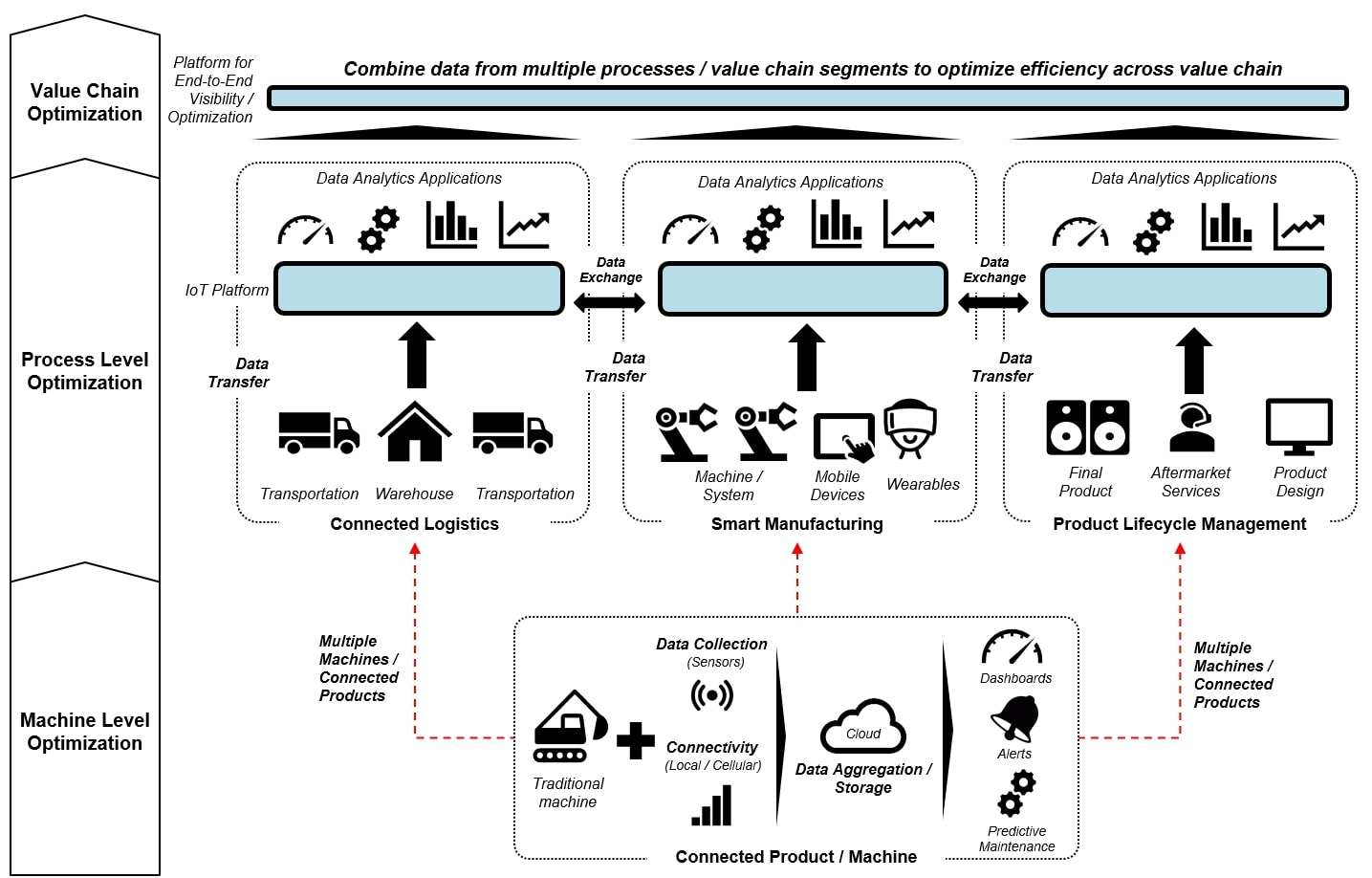

Connecting the World Together

Most manufacturers today are still in the early stages of the product-to-service progression, centered around developing the capabilities required to take part in Industry 4.0. Building value from Industry 4.0 starts at the individual machine / device level – these can be components, tools, robots, finished products, or anything in between and serve as the foundation of Industry 4.0, where most of the data is collected. As more and more devices within a process (e.g., manufacturing, logistics) are connected, the data pool from which insights can be extracted grows and can eventually enable process-level or value chain optimization. (See Figure 2)

For insights to be gleaned at the process or value chain level, there needs to be: 1.) a sufficient level of connected products employed across the value chain, and 2.) full exchange of data between equipment, even if sold by competitors. Putting aside core hardware enablement, the second point runs counter-intuitive to how many industrial companies think about their products and competition – these companies try day-in, day-out to beat their competitors, and now are asked to work together and share data. This mindset will likely require a change in culture to be more open to data sharing and collaboration and may slow down Industry 4.0 / connectivity initiatives in the meantime.

Figure 2 – A Connected World

Device-Level Data: The Foundation of 4.0

Industry 4.0 is fundamentally rooted at the device level – even if data analytics are run to optimize a process, device operations are what gets altered to effect this change. The first step in the progression to Industry 4.0 services requires embedding connectivity hardware and sensors in new equipment to collect and transmit data along with the necessary backend infrastructure (e.g., data storage, cellular service) to properly manage data collection, qualifying the product as an Internet of Things (IoT) device.

Initial implementations of connectivity may only focus on one-way communication, where data is collected and transmitted, but lack the ability to receive data or adjust operations remotely. In these implementations, applications will be rudimentary (e.g., basic alerts or status monitoring). Additionally, edge-level intelligence, such as a basic processor (e.g., Raspberry Pi) can also be implemented, which unlocks a bevy of new features. Instructions can be relayed back to the devices remotely, enabling adjustment of device operations without having to send technicians to change it directly. With the proper software and data analytics, devices may be able to monitor data being collected and automatically adjust device operations to optimize efficiency in changing environments. However, connected devices only represent the hardware aspect of Industry 4.0 – fundamentally, Industry 4.0 represents the digitization of the manufacturing and industrial value chains, which will primarily be driven by software.

Hardware Players in a Software World

“Software is eating the world” has been a mantra of technology analysts and investors since Marc Andreessen first coined the phrase in 2011 to the point where it has become a cliché. The notion that the core functions of hardware now take a backseat to value unlocked by software has permeated every industry and forced companies large and small alike to ask themselves how they can incorporate software into their existing offerings.

The need for software is essential in an Industry 4.0 context – a significant pillar of Industry 4.0 rests on the idea that data, if used correctly, can optimize the efficiency of industrial processes. As such, advanced software represents the second stage in the product-to-service progression for manufacturers to unlock the full value of 4.0. Currently, there is an immense amount of data being generated worldwide, and connected industrial products will only add to the flood of new data. The task of merely organizing and preparing the data for analysis is not something that a human can do in a timely manner; instead, software algorithms and platforms will do the heavy lifting when it comes to data.

Going forward, the critical issue facing industrial players is how to navigate this new environment where hardware specifications start becoming less important, and customers begin demanding connectivity, software capabilities, and platform integrations. The core competency of hardware players is manufacturing high-quality equipment, not developing software or coming up with insights based on data analytics; manufacturers will have to decide how they want to participate in this new paradigm. This decision will determine whether they progress on the Industry 4.0 journey or stop at the connected product level.

Enabler or Insight-Driver?

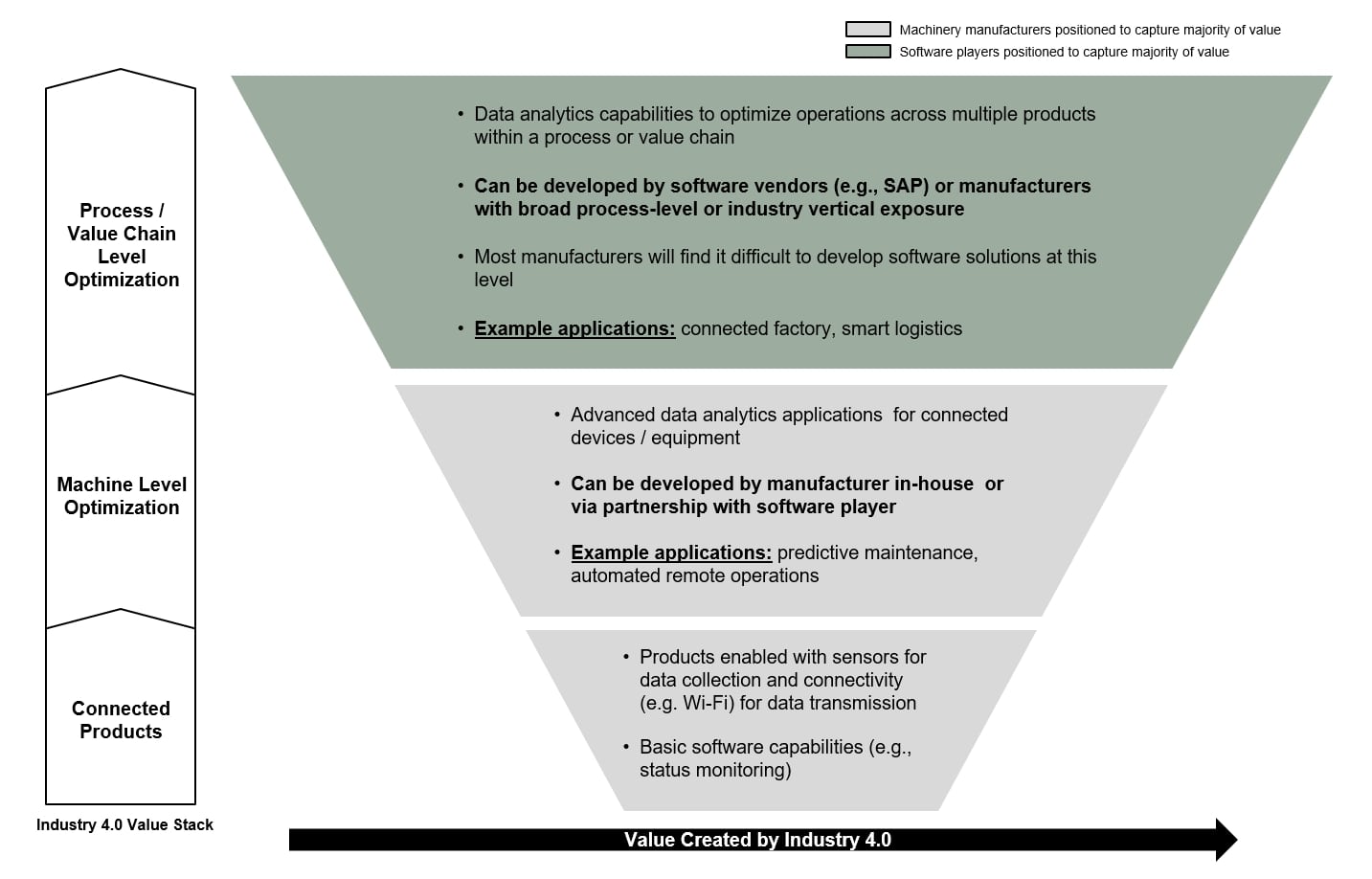

Within Industry 4.0, there is value to be captured across all stages of development, from just enabling connectivity, to producing device-level analytics, to optimizing efficiency across a process or value chain (See Figure 3). This mirrors the journey that manufacturers will have to undertake to shift from product to service-based offerings.

Figure 3 – The Industry 4.0 Value Stack

While value can be extracted across all aspects of Industry 4.0, the amount of value created varies significantly – there’s only so much value that can be driven from a simple status notification or a stream of raw data that is provided by connected products. The value that can be created with more advanced device-level or process / value chain-level analytics is substantially higher. However, the difficulty of capturing value also increases substantially, particularly at the process / value chain level. This increase in difficulty is due to the complexity involved in managing and optimizing myriad devices, most of which will not be made by the same manufacturer. Additionally, the level of software sophistication required to analyze and develop process / value chain level insights adequately would require massive investments to build organically, particularly for industrial players with no previous experience in software development.

Ultimately, the ability to add streams of real-time data can unlock new offerings and business models (e.g., predictive maintenance), while also ensuring competitiveness as connectivity becomes an increasingly standard feature on machinery. Manufacturers looking to take a leadership role in the evolution to Industry 4.0 will find that the decision to develop software will a be a critical stage gate in the progression from product to services.

The Software Decision

Once a manufacturer’s devices are enabled with data collection and connectivity, the first stage of the Industry 4.0 journey is complete – the next step is determining the extent of a manufacturer’s participation in software. For many manufacturers, a focus on the connected product level will be the logical choice – they are most familiar with the operations of their assets and needs of their customers, and Industry 4.0 can enhance both aspects without getting too far into the complexities of managing / optimizing processes and value chains. However, even at a device level, manufacturers will be faced with the decision of whether to pursue software / analytics capabilities or to remain a hardware-centric enabler by solely embedding connectivity into their product lines.

Some manufacturers, particularly those with less complex products (e.g., low-end instrumentation), may find that enabling connectivity may be the extent of their participation in Industry 4.0 – dedicated software platforms (e.g., GE Predix) can do the actual monitoring and analytics. With smaller products / components, there is less operational complexity, moving parts, and pain points to track – a simple sensor to monitor flow or temperature may suffice. These players may not see significant value in the development of a dedicated software package for their products, electing instead to buy / partner with an existing data analytics package or simply integrate with major data analytics platforms.

Manufacturers of more advanced equipment (e.g., motors, turbines) will find it more difficult to forgo development of software specific to their products – they are exponentially more complicated and are utilized in critical applications. For example, understanding the wear and tear on an aircraft engine or turbine and developing a customized predictive maintenance solution can add years to the life of a machine and lower consumer risk. While a partnership with an existing software player is still a viable option, the complexities involved in understanding how the device works and what aspects of the operation to monitor is something that the manufacturer itself is uniquely positioned to answer – simply being a passive player and enabling connectivity is not enough.

Software Value at the Device Level

For an individual device, value can be extracted throughout the value stack, but there are two stages where most of it is unlocked: 1.) advanced analytics to improve the operation of the device, and 2.) working in concert with other connected devices to optimize process and value chain efficiency.

In the first stage, the set of data analytics solutions are device-specific and have independence from broader process / value chain constituents; examples of value propositions in this stage include status monitoring, real-time alerts, and predictive maintenance. These value propositions are limited to individual devices and can be useful for developing a digital overview, or “digital twin” of operations, providing an operations professional a real-time method to track and monitor how a device is operating. Additionally, predictive maintenance can reduce operating costs by minimizing unexpected downtime and lowering spare part inventory requirements.

After core connectivity is enabled, manufacturers will face another critical decision point regarding the inclusion of not just connectivity, but also intelligence on their products. The inclusion of intelligence on a device morphs a connected product from a simple data collector to a true “smart” device, relaying data in real-time and adjusting operations based on instructions received from analytics platforms. Without this intelligence, any modifications to the device’s operations would still have to be adjusted manually, which can be tricky with devices in remote environments (e.g., turbines, compressors). Setting aside the intelligence decision, investment in a baseline level of analytics capabilities will be critical for manufacturers to remain competitive as customers increasingly emphasize non-product related value propositions.

The second stage, extracting data from multiple connected devices used in the same process and leveraging Big Data analytics and artificial intelligence to optimize the way the processes run, may be outside the realm of many manufacturers. This type of analysis requires significant investment in cutting-edge machine learning and artificial intelligence technologies and positions the manufacturer as a competitor to the leading technology companies trying to develop similar solutions (e.g., Google, SAP).

As a result, most manufacturers will not partake in process-level analytics / optimization, opting instead to integrate their products with major data analytics platforms, using open APIs and industry standard protocols to share data and focusing on ways to improve their existing products. For most manufacturers, developing product-specific services represents the final step in the Industry 4.0 journey, allowing manufacturers to potentially redefine themselves away from today’s traditional supplier role.

Getting Closer to the Customer

Beyond the device-level operational benefits that manufacturers can market, the data collected from connected devices can help manufacturers develop stronger relationships with their end-customers, and in some cases, allow manufacturers to create a direct-to-end-user channel supplementing indirect channels like dealers / distributors. For many hardware manufacturers (e.g., valves, hydraulics, etc.), the nature of their product and channel to market limits interaction with end-users; typically, a dealer or integrator buys their product and includes it in a complete package for the end-user. With the development of software capabilities, manufacturers can offer additional value in a way that most indirect channel players are unfamiliar with and may not have the expertise to properly manage (i.e., desktop / mobile apps).

Manufacturers that develop credible software solutions, such as status monitoring or predictive maintenance, can sell directly to their end-customers. This allows them to establish a direct-to-end-user channel, then leverage that relationship to expand the company’s presence within the end-user. Additionally, the data collected and solutions developed can help transform the perception of the manufacturer from that of a supplier to a strategic partner. Using this relationship, manufacturers can provide consultative services or pursue an “outcome-based” model, where the manufacturer becomes invested in the success of their customers, a true partnership model.

The Outcome-Based Model

One potential consequence of Industry 4.0 is the introduction of a new business model – the “outcome-based” model, where customers pay for the outcome provided by the product, not for the product itself; this represents the final leg of the of the Industry 4.0 journey. These outcomes can take the form of agreements (e.g., uptime guarantees), level of output (e.g., kWh of electricity) or other quantifiable measures – the key theme being an outcome that can be quantified. An outcome-based business model cannot be used if there is insufficient data to prove that an outcome has been reached, highlighting the importance of connected devices as the foundation of an Industry 4.0 journey / strategy.

For customers, an outcome-based model can ensure that the product they are buying matches with the needs of their enterprise, while for manufacturers, outcome-based models can help players prove the quality of their products and differentiate from competitors. This differentiation is critical as manufacturers continue to grapple with the commoditization that is occurring across industrial markets due to players from low-cost regions. Additionally, the outcome-based model allows for deep relationships between suppliers and customers, as the two parties can collaborate to ensure correct outcomes are achieved, moving the manufacturer away from a supplier to a strategic partner. This relationship can then be leveraged to maintain customer loyalty or expand the manufacturer’s presence within an end-user.

Outcome-based models are already being piloted by players like Rolls-Royce for their engines and GE for their turbines, and as more products are enabled with connectivity and data collection, outcome-based models may become more prevalent. Software players may also start experimenting with outcome-based models as their analytics capabilities expand – for example, SAP may charge based on improvements to factory output or a fleet telematics provider can charge based on how much money their client saves.

While outcome-based models will require significant scaling in connectivity and more advanced data analytics capabilities, it represents a unique business model in the industrial space, driven by the data and connectivity that are the building blocks of Industry 4.0. Outcome-based models represent the end-goal manufacturers should strive for in their Industry 4.0 journey and would transition them away from a product-centric model towards a services-based model.

Beyond Devices – Into Processes and Value Chains

During the Industry 4.0 journey, manufacturers have a choice to focus on software development for their own product portfolio or expand their addressability to other value chain segments / products as well. If manufacturers move beyond individual devices and into processes / value chains, they will be forced out of their traditional hardware environment and into a software-focused world. At a process / value chain level, all the hardware has already been installed; instead, the focus is on taking the data that is generated by the device and applying analytics to provide actionable insights to their end-users.

Setting aside the investment needed to develop such capabilities, working at a process / value chain level means being able to understand / work with all the hardware within that process, and it is for this reason that most manufacturers will be unable to progress beyond device-level analytics. Most manufacturers only supply equipment for part of the process, and while they are fully aware of the idiosyncrasies of their own products, their understanding of other aspects of the value chain will be lacking. Only the manufacturing players that control the process (e.g., Siemens, Rockwell) or ones that manufacture critical equipment and invest heavily (e.g., GE) may be able to participate at the process / value chain level of Industry 4.0.

For automation players like Siemens and Rockwell, Industry 4.0 represents a natural extension of their existing process automation capabilities, and their underlying understanding of how each device in a process works with another, along with their entrenched position in factories, afford them strong advantages over manufacturers that may have limited process visibility. With their historical roots in programmable logic controllers (PLC) and manufacturing execution systems (MES), process automation players already comprise the backbone of factory automation today and have invested heavily in bringing those capabilities from the factory floor to the cloud.

For enterprise software players such as SAP, advantages exist due to their agnostic nature and software development core competency. While a software player typically does not have in-depth knowledge of an industrial process or operational intricacies of a machine, their ability to work with manufacturers of equipment to turn knowledge into algorithms and insights is a comparative advantage. Additionally, there is an advantage in implementing, deploying and scaling analytics solutions that manufacturers have little to no experience comparatively. Their expertise in selling and managing a Software-as-a-Service (SaaS) model is an additional advantage vis-à-vis manufacturers used to selling software as a one-time sale, not an ongoing subscription. SaaS models have different sales cycles, sell into separate silos within organizations, and may focus on qualities that manufacturers are unfamiliar with, such as cloud computing and cybersecurity.

To this end, full Industry 4.0 participation will require a radical transformation from a hardware-centric company to a hybrid hardware / software company; without a determined push and significant investment, such a transition will be difficult to accomplish. For example, just building out a platform to handle the incoming data from various IoT devices, aggregating / cleaning, and storing the data so that analysis can be conducted is a complex task. While white-labeling / partnering with existing IoT platforms is possible, manufacturers will still be tasked with managing the data, developing APIs to allow for the exchange of data, and critically, developing the analytics that add value to the entire process / value chain, a mountain that most manufacturers will be unwilling to climb.

For this reason, manufacturers will likely cede the process / value chain analytics portion of Industry 4.0 to players that have a more holistic view of industrial value chains or software players that can integrate knowledge from across the value chain in a streamlined, insight-driven manner.

Reflecting on The Industry 4.0 Journey

As is the case with many industry transformations, Industry 4.0 is both an opportunity and risk for manufacturers. However, both the nature of Industry 4.0’s influence and the scope of impact make Industry 4.0 a unique challenge for manufacturers to address. For the first time, manufacturers may need to expand outside their core competency of hardware devices into software solutions. This will be a whole new world for manufacturers, and while some (e.g., GE, Siemens) have already invested heavily in software capabilities, most manufacturers are ill-equipped for the Industry 4.0 journey, particularly when it comes to software. Additionally, many manufacturers have not developed a defined strategy / roadmap for connected devices, which is the foundation of Industry 4.0 – however, time may be running out as the speed of Industry 4.0 adoption will likely accelerate as more devices, software solutions, and platforms come online; manufacturers that choose to delay investment may find themselves struggling to compete in an increasingly connected world.