With great frustration, many find that they are unable to tap into a cohesive set of data that provides a complete and current view into their portfolio – let alone one that integrates legal, technical, and business information. Instead, they face siloed, incomplete, and often stale data that does not adequately support decision making and too often goes little further than basic docket management-type data.

Approach

In these situations, a true portfolio knowledge management (KM) capability is required – one that builds a real-time, comprehensive overview that supports real-time decision making. Red Chalk Group uniquely supports companies as they build this capacity for portfolios ranging in size from a single patent to over 10,000 patents. Typically, our role in these engagements is threefold:

- Thoroughly categorize and assess the IP assets

- Develop hypotheses for monetization and cost savings opportunities

- Deploy proprietary KM tool suite to support distribution, collaboration, and real time updates

The challenges in this type of activity are many given the different skill domains involved and diversity of internal constituents involved such as BU leads, R&D, technologists, legal, and IT.

In recent engagement, a large telecommunication company with over 2,000 patents engaged Red Chalk Group to create an end-to-end portfolio knowledge management solution. This effort played a part in laying the foundation for a monetization program and for a fact base to support cross licensing discussions.

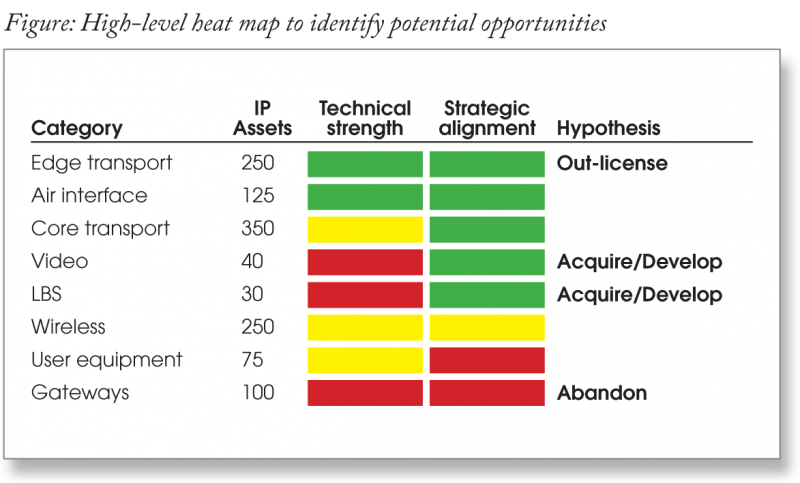

First, the IP assets were categorized into 100+ custom categories and scored for technical strength using a proven methodology which assesses areas such as significance of innovation, detectability, market stage, priority, substitutability, and standards’ relevance to create an overall view into the portfolio’s technical strengths and weaknesses.

Here, as in all our engagements, Red Chalk Group relied on its team of industry experts to manually read patent claims and specifications (as opposed to relying on calculated metrics), and was able to effectively integrate technology and market based information.

Next, to develop a hypothesis for monetization and savings opportunities, the team integrated analysis across technology, business, and markets to prepare “heat maps” that ultimately directed management discussions in areas such as R&D prioritization, prosecution strategy, and core vs. non-core technologies which led to over four significant monetization opportunities. In addition, the analysis provided a fact base for future cross-licensing discussions.

Client Impact

Red Chalk Group successfully deployed its portfolio management tool suite in the client’s intranet allowing a diverse set of users to share assessment data and collaborate. An early benefit was the ability to identify and act on two monetization initiatives which resulted in patent sales.

The ultimate value of a robust portfolio is knowledge management capability lies is in providing senior business and IP management with a common information baseline for the IP assets that enables an integrated business and IP discussion – ultimately positioning their company for greater success.