Abstract: Virtual Reality (VR) has been thrown around and experimented with since the early 90s – recently, it seems like every year is “The Year of Virtual Reality”. Significant investment by tech giants such as Google, Facebook and HTC has created hardware that can start to live up to the hype that surrounds the industry. Content creators that have been looking for hardware that is able to replicate the experience they want to provide can finally develop games, movies and apps that take full advantage of a virtualized environment. Against this backdrop, competition in the industry will not be focused on providing better hardware; instead, controlling content and providing a content aggregation platform for consumers will be critical for players to fully monetize VR.

AR/VR: The Next Generation of Media & Entertainment

In an era marked by significant ecosystem shifts, the media and entertainment world is positioned to experience yet another significant change, driven by the adoption of AR/VR (Augmented Reality and Virtual Reality). Parallel to themes including rising OTT consumption, direct-to-consumer distribution models, and 4K/8K UHD content, next generation computing platforms broadly referred to as “AR/VR” will fundamentally alter elements of the human-machine interface, entertainment UI/UX, and content-environment immersion.

Defining AR/VR

Akin to prior computing advancements, AR/VR represents an evolved computing platform that, like the PC and smartphone, aims to amplify the user interface through a combination of gesture, movement, and voice. Importantly, the 3D nature of AR/VR facilitates “real-world” immersive experiences, altering the content experience and potentially expanding social media interactions, much like the modern smartphone has done for the past decade.

The Roadmap for Adoption

Near-term, the journey to broad adoption of AR/VR will likely start with the increasing penetration of VR platforms, first for entertainment applications, followed by social use cases. Single- and multi-user gaming, live-event filming, and social interactions could experience significant enhancements. Long-term, AR will accelerate as the locus of activity as advances in both technology and seamless integration in daily lives will take place. The role and scope of the modern PC and smartphone may evolve, with AR devices either supplementing these CE devices, or supplanting them entirely. Eventually, a combined device / platform model may emerge that integrates elements of VR and AR, resulting in a “mixed reality” for users.

This 1st of two articles on the AR / VR landscape will focus on the VR ecosystem, dynamics, and player strategies.

Setting the Stage – Competitive Dynamics Today

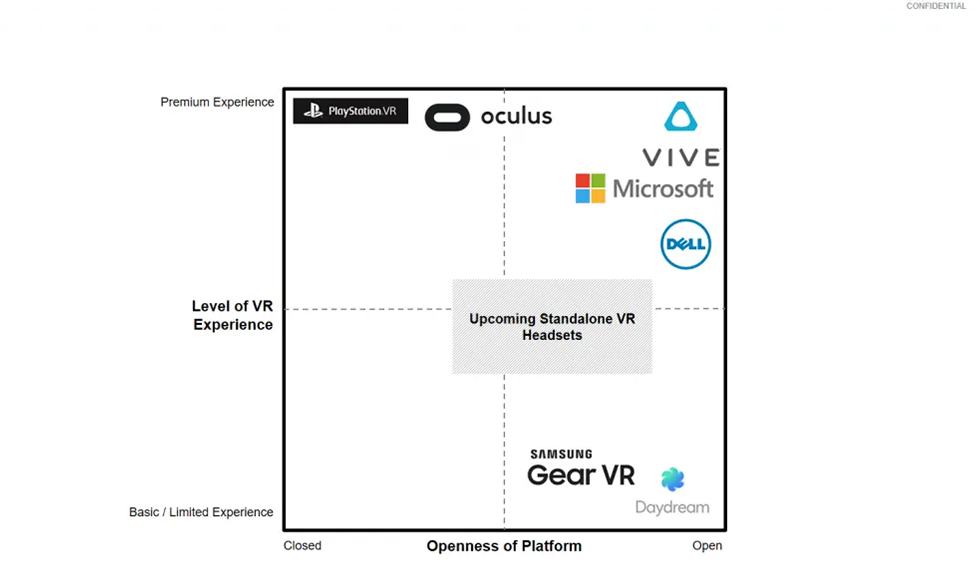

Currently, the competitive landscape for the VR headset market consists of 3 major PC players – Oculus (Facebook), HTC Vive, Sony PSVR – in contrast, Google’s Daydream and Samsung’s GearVR (developed by Oculus) platforms focus on the mobile space. These players have unique go-to-market strategies which can be defined by the technological sophistication of their equipment and openness of their development platform. However, while go-to-market strategies may differ, monetization strategies are similar – each is attempting to build a “virtuous cycle” where a robust content ecosystem encourages customer adoption, prompting further content development. (See Exhibit 1)

Exhibit 1 – The VR Headset Competitive Landscape

Troubles for HTC? – The Price Conundrum

One major point of differentiation is how advanced each player’s hardware is; one extreme is the “best-in-class” HTC Vive. Not only is the Vive the most expensive VR headset on the market, it also requires a significant investment, typically upwards of $1,000, in a desktop computer powerful enough to run the apps – the benefit for the consumer is a significantly enhanced VR experience. On the other end of spectrum is the Google Daydream, which is a phone-based, lower-quality ecosystem that is focused on proving an economical way to experience VR.

Originally, there was a clear bifurcation between enthusiasts who opted for the Vive, PSVR or Oculus versus the casual fan who went with the Daydream or similar product. However, as the VR ecosystem matures, premium players may run out of early adopters and be forced to reduce prices to appeal to a broader mass market base of customers. Oculus reduced its price by $200 in July and HTC matched this reduction a few weeks later. Sony was also not immune to the price-reduction trend, cutting the price of its PSVR system in late August. These reductions may signal a red flag for the Vive in particular, as its parent company HTC recently announced a 9th straight quarter of losses. Couple this with the fact that Oculus hardware wasn’t profitable at the Vive’s current $599 price point and there are serious concerns as to the ability for HTC to continue to subsidize development of the Vive, something confirmed by recent reports about HTC exploring strategic options, including divestment of the Vive unit. Without financial resources of tech giants like Sony, Facebook or Google, HTC may be forced to cut back development, especially if its standalone headset underperforms.

Bring VR to the Mainstream – Standalone Headsets

The standalone VR headset is what industry analysts believe will bring VR to mainstream consumers – a premium VR experience without the need for an expensive PC to run it. HTC was the first to announce such a product in July, targeting the China market; competitors are not far behind, with both Google and Oculus rumored to launch similar products before end of 2017 in the US. However, these devices will need to navigate number of roadblocks before success. They must strike a balance between offering a better VR experience compared to phone-based products while not being too expensive for mainstream consumers. In addition, the content ecosystem must have a diverse set of offerings that appeal to a broader set of consumers. From an operational perspective, the headsets are expected to work seamlessly as mainstream consumers are expecting a polished product akin to smartphones. The combination of these roadblocks will make it difficult for a player to succeed on its first attempt – unfortunately, for HTC, it may not have too many additional chances. For others, a failed first attempt can be absorbed and improved upon, as the risk can be borne by larger, profitable parent companies.

No Surprise – Content is King

While hardware specifications and pricing are important for consumer adoption, compelling content will be always be the primary factor. The two predominant types of content platforms differ by the openness of the platform, with Facebook and Sony choosing to gate their content behind a closed platform whereas HTC and Google have allowed any developer to create content for their ecosystems. The “open vs. closed” decision has wide-ranging impact on the development of each ecosystem, particularly for VR content aggregation.

Consoles 2.0?

The closed, “walled garden” content strategy that Oculus and Sony are pursuing draws many parallels with the video game console industry, the “spiritual predecessor” to VR. Microsoft, Sony and Nintendo duked it out across proprietary hardware and “exclusives”, or games that could not be found on other consoles. This is appearing again in the VR space – HTC has its own store to buy games from, as do Oculus and Sony. Facebook is allocating significant funding to developers to make exclusive games for the Oculus whereas Sony has leveraged its historical relationships and expertise to create its own content. This support has led to the creation of a content advantage for Oculus and Sony, protected through their exclusives and closed platforms. The potential for a repeat of the “console wars” has industry participants worried; however, unlike the console market, the PC-based nature of VR ecosystems has allowed a critical 3rd party content aggregator to emerge as an alternative path: Valve and its ubiquitous Steam platform.

The Behemoth

Unlike the console market, PC gaming does not have the concept of exclusives as games are typically compatible on all hardware powerful enough to run the game. The Steam platform grew to prominence as a way for consumers to organize their digital library and find new content – Valve itself has developed a few games, preferring to serve instead as the distribution channel for the era of digital downloads. Its presence is massive, controlling nearly 15% of the global PC game market and serving as the platform for thousands of game launches – it also serves as the main content partner for HTC’s Vive platform.

The nascent VR space was a natural adjacency and expansion opportunity for Steam and its role is very similar; it serves as a content aggregator where consumers can buy and play games for both the Vive and Rift. Its future ambitions are likely a continuation of their presence in the PC space – they want to keep as many consumers tied to the Steam platform as possible; a customer purchasing a game via Steam means Valve generates commission dollars, no matter which platform the user has. In this respect, Valve will need to ensure its platform is compatible with any player, and efforts to move the industry towards open platforms will ultimately benefit Valve.

Cutting out the Middleman

The video game industry has typically been beholden to some kind of middleman to distribute their games, whether it be “brick-and-mortar” retailers or online marketplaces like Steam. Unwilling to let Steam attain the same position it had in the PC market, both Oculus and HTC have launched their own stores, attempting to leverage the electronic distribution channel to sell directly to customers at scale. These stores have “exclusives”, or games that are only for sale on those specific stores; while a user may be able to use Steam to manage the game, it must be purchased directly from the manufacturer.

While it would be beneficial in the long run for manufacturers to move all of their games to their own platforms, structural aspects of the video game industry will likely prevent this from coming to fruition. The strategy is dependent on game developers putting their content on a single platform, which would not be in best interest of the studio – the lost revenue is made up through exclusivity deals that compensate the studio to not release their content on other platforms. Oculus has used this to build a healthy library of exclusives; however, as the ecosystem continues to develop and the consumer base grows, these deals will become more expensive and reach a tipping point, whereby even behemoths like Facebook will perceive subsidizing content as prohibitive.

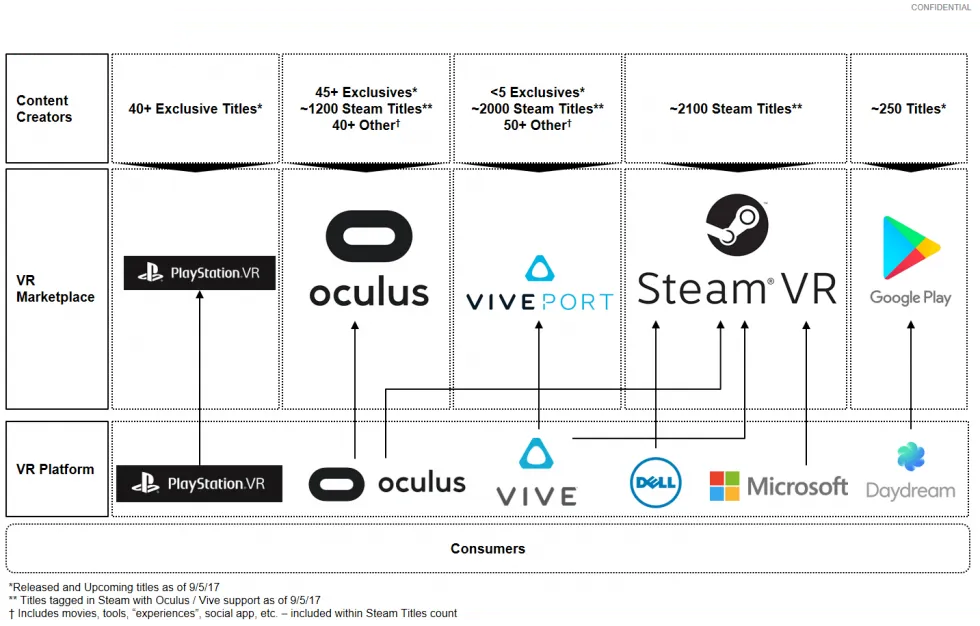

The other structural aspect that limits usage of these direct-to-consumer platforms is the longevity and familiarity that users have with the Steam platform compared to the relative nascence of manufacturer platforms. A lackluster social experience, unpolished technical backend, and general “inertia” in switching platforms will likely thwart mass adoption of manufacturer platforms, rendering SteamVR a key player for the long run. (See Exhibit 2)

Exhibit 2 – VR Content Marketplaces

Here Comes the Rest of the Gang

Browsing the list of tech giants investing in VR, there were a number notable players missing – Microsoft, Amazon, Nintendo, to name a few. While Microsoft had its Hololens project, it was missing a true VR headset until recently, when it announced a unit with comparable specs and price to HTC / Oculus. Rumors have emerged regarding VR capabilities on Nintendo’s latest console, the Switch, and even PC players like Acer, Lenovo and Dell have announced their own VR headsets for either phones or PCs. As the ecosystem continues to develop and mainstream customers climb aboard the VR train, additional investment and fragmentation is expected.

The winner in this renewed round of investment in the industry is, unsurprisingly, Valve. As later entrants, seek to drive market share / adoption via exclusives, a hard and expensive task, these players have started to recognize the unsustainable nature of this strategy – outside of Nintendo’s unique position as a console-based system, both Microsoft and Dell have announced compatibility with SteamVR. As an agnostic 3rd party platform, no matter what system a game is used on, if purchased via Steam, Valve wins. Continued fragmentation and new-player entry into the ecosystem will only serve to strengthen Valve and solidify its position as the “platform of choice” for content aggregation in the VR ecosystem.

VR in your Pocket

While phone-based VR platforms have been launched by players like Google (Daydream) and Samsung (GearVR), user experience is very limited vis-à-vis tethered or even standalone VR units. While the low pricing and bundling with new phones may be attractive enough to garner some consumer attention, long-term adoption of phone VR seems unlikely given hardware limitations (i.e., only high-end phones) and critically, no phone VR headset from Apple. The lack of concrete information around an Apple-branded VR phone headset from Apple may be a sign that they do not view this segment as an opportunity.

Ultimately, phone-based headsets may be a stepping stone towards standalone VR headsets, introducing the public to VR and catalyzing a market segment that has been gaining significantly interest lately – Google recently announced their own standalone headset, partnering with both HTC and Lenovo to develop the hardware while Apple, Facebook and Samsung have been rumored to be preparing similar products.

Don’t Underestimate Mario

The final set of players in the VR ecosystem are the video game endemics – Sony and Nintendo. Sony is already a market leader via its PSVR accessory for the PS4; Nintendo has publicly acknowledged that they are exploring VR for the Nintendo Switch. Unlike PC-based platforms, a key advantage these players have is the ability to sell VR as an add-on for their consoles – there is no need for the consumer to go out and purchase additional hardware, and moreover, all sales can be controlled through their own stores.

Outside of these structural advantages, the real “X-factor” for Sony / Nintendo lies within their content creation capabilities. Nintendo’s Wii is a “spiritual ancestor” to VR and afforded them significant experience with motion-based controls. Critically, it also has the franchises and expertise necessary to create the first “killer app” for VR – iconic characters like Mario, Link and Pikachu that can single-handedly drive hardware sales, as indicated by the Switch. If Nintendo can harness the “Nintendo Magic” again with VR, it would put itself in a unique situation where it not only controls its content ecosystem, but also creates a library of exclusives that no other competitor will ever have.

VR Outside of Games

While most VR development occurs in the gaming vertical, there are several non-gaming applications that are starting to gain traction:

- Film: Film studios can leverage VR capabilities to create immersive experiences that you cannot replicate anywhere else – VR short films have already won awards (e.g., Oculus) and wowed audiences even in a nascent stage. Additionally, it can appeal to consumers outside of the normal gaming demographics.

Another interesting implication is the impact this will have on content distribution – already struggling movie theaters are unlikely to put up the capital to outfit their locations with VR, leaving direct distribution via SteamVR, Oculus Home or other platforms as the de-facto distribution method. Netflix could potentially look towards VR movies as a content differentiator as it grapples with intensifying competition in the OTT ecosystem – they may look for partnership opportunities with major headset manufacturers. - Training / Education: Industrial companies have started to leverage VR environments as a new way to train workers on product specifications, selection and repairs; UPS recently announced an initiative to train workers using VR headsets. Physicians and other health professionals may eventually also be able to leverage VR to map out complex surgeries or train students more effectively.

- Commerce / Business / Sales: Businesses such as car dealerships can use VR to give prospective customers a more “realistic” view of the car, along with showing them how interiors would change given different options. Natural extension of this use case can be for furniture or other home-related purchases. Businesses can also use VR to help their designers visualize products and create prototypes, reducing time-to-market.

- Tourism / Travel: Cities can use VR to promote tourism more effectively than current marketing methods or allow consumers to get a better sense of what they can get with their stay. In the future, VR can also open up experiences that were normally out of reach of most consumers, such as excursions to see wild animals. A balance will have to be achieved between enticing new visitors and giving too much away.

Looking Forward

While VR evangelists have been saying “this is the year” for some time now, the industry may be finally reaching the tipping point: hardware prices are falling to levels that can attract mainstream customers, a series of imminent launches of standalone VR headsets, and a library of content large and diverse enough to sustain consumer interest. Some ecosystem topics to keep an eye on are:

Marketplaces: As the industry continues to develop, look for the various manufacturers to look for ways to carve out middlemen like Valve as Valve works towards solidifying its position in the ecosystem.

Apple’s Role: Apple has been conspicuously silent on its own VR plans – a concrete announcement as to the hardware and experience it will develop will signal where Apple thinks the industry’s opportunities lie.

HTC’s Future: HTC will be under heavy pressure to sell their Vive division as it struggles with weakness in its phone segment – the buyer of Vive will gain a technology leader with one of the larger installed bases and allows rapid entry for a player that’s been sitting on the sidelines, enabling them to jump to the forefront of the industry.

Content Exclusives: The industry is still seeking a “killer app”. Facebook / Oculus have invested a significant amount in content creation, but have yet to hit on a piece of content to bring VR to the mainstream. Nintendo and Sony have opportunities to drive consumer adoption towards their platforms through engaging content and can leverage their captive console audience as well as a long line of beloved franchises and characters.